Index range: -31 to -51, Bearish; -11 to -30, Mildly Bearish; 10 to -10, Neutral; 11 to 30, Mildly Bullish; 31 to 51, Bullish.

Millionaire Interest in Real Estate Investing Grows to its Highest Level Since 2014

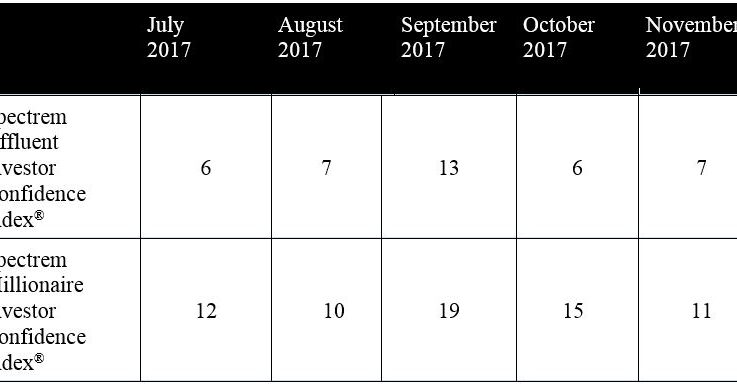

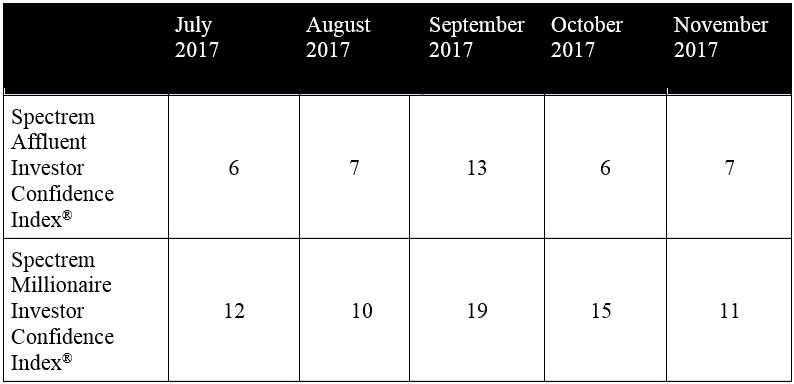

CHICAGO, IL, UNITED STATES, December 1, 2017 /EINPresswire.com/ — With prospects for significant U.S. tax reform increasing, economic growth accelerating and stock markets continuing to climb, Millionaire investors may be adjusting their strategies in anticipation of an eventual course correction, Spectrem Group reported today in its High Net Worth Insights newsletter. The Spectrem Millionaire Investor Confidence Index (SMICI®) declined four points in November to 11, the second consecutive month in which this has occurred. While less optimistic overall, non-Millionaire confidence rose slightly in November, represented by a one point increase to 7 in the Spectrem Affluent Investor Confidence Index (SAICI®).

The monthly Spectrem Investor Confidence indices track changes in investment sentiment among the 17 MM households in America with more than $500,000 of investable assets (SAICI), and those with $1 MM or more (SMICI). This month’s survey was field between Nov. 15-23.

Among Millionaires, the intention to invest in stocks and stock mutual funds dropped to its lowest point since May, with just 38.5 percent indicating they planned to do so in the coming month. Non-Millionaires reported slight increases in equity investing, and reported fewer investors planning to stay on the investment sidelines for the month of December.

While edging away from equity investments, Millionaires reported a sharp spike in real estate investing, with 12.6 percent expressing interest in that category, the highest percentage among Millionaires since July of 2014.

Confidence is also split along gender lines, and while male investors usually report greater confidence than females, male and female Millionaire indices were unusually close in November. Millionaire males reported a confidence index of 12 (down from 23 in September) while females reported an index of 9 (up from minus-6 in August).

The Spectrem Household Outlook, which measures long-term confidence in four financial factors impacting a household’s daily economic life, displayed a massive improvement among non-Millionaires. The Outlook for non-Millionaires rose from 18.94 to 32.83, the highest mark among non-Millionaires since February of 2006, two years before the Great Recession. The Outlook among Millionaires fell more than 11 points to 26.48, and is below non-Millionaires for the first time since August. The non-Millionaire Outlook for the economy rose to 26.96, the highest in almost three years.

“While investors are benefiting from continued growth in equity funds, Millionaires may be wondering how much longer this aging Bull Market can last and are shifting assets into real estate,” said Spectrem President George H. Walper, Jr. “On the other hand, sustained stock market growth may be positively affecting the economic outlook for those investors who aren’t quite as wealthy, creating continued optimism among that segment of the population.”

Charts, including a deeper analysis of the Index and its methodology, are available upon request. Additional insights include:

• Investor Confidence Not So Confident in November

About Spectrem Group: Spectrem Group (www.spectrem.com) strategically analyzes its ongoing primary research with investors to assist financial providers and advisors in understanding the Voice of the Investor.

# # #

George H. Walper, Jr.

Spectrem Group

(224) 544-5350

email us here

![]()

This Article Was Originally Posted at www.einnews.com